In the article “How Are Tiny Homes Insured?”, you will explore the fascinating world of insurance for these compact living spaces. Discover the unique challenges that come with insuring tiny homes and uncover the creative solutions that insurance providers are adopting to protect these unconventional dwellings. From understanding the importance of coverage to navigating potential risks, this article provides valuable insights into the insurance landscape for tiny homes. So, let’s embark on this informative journey together and unravel the intricacies of insuring these remarkable abodes.

How Are Tiny Homes Insured?

Understanding Tiny Homes

Tiny homes have become a popular housing option for many people looking to downsize or live a more minimalist lifestyle. These compact dwellings, typically between 100 and 400 square feet, provide all the necessary amenities in a smaller and more efficient space. However, when it comes to insuring tiny homes, there are unique considerations that need to be taken into account.

Importance of Insurance for Tiny Homes

Insurance is a crucial aspect of owning a tiny home. Just like any other type of property, tiny homes are vulnerable to accidents, natural disasters, and theft. Without proper insurance coverage, you could be left facing significant financial losses if something were to happen to your tiny home. Therefore, it is essential to understand the importance of having insurance for your tiny home.

Factors Affecting Insurance for Tiny Homes

Several factors can affect the insurance options and premiums for tiny homes. These factors include the building materials and construction quality, the location of the tiny home, and the intended use of the tiny home. Understanding how these factors can impact your insurance coverage is crucial in finding the right policy for your tiny home.

Understanding Tiny Homes

Definition of a Tiny Home

A tiny home is typically defined as a fully functional, self-contained dwelling that is significantly smaller than a traditional house. The size of a tiny home typically ranges from 100 to 400 square feet, although some may be slightly larger. These homes are built to maximize space efficiency while still providing all the necessary amenities for comfortable living.

Types of Tiny Homes

There are various types of tiny homes, each with its own unique design and construction. The most common types include:

- Tiny Houses on Wheels (THOWs) – These are tiny homes built on trailers, allowing for easy mobility. THOWs are a popular choice for those who wish to travel or have the flexibility to relocate their home.

- Foundation-Based Tiny Homes – These tiny homes are built on a permanent foundation and can range from being attached to an existing property to standalone structures.

- Shipping Container Homes – These tiny homes are constructed using repurposed shipping containers and offer a more modern and industrial aesthetic.

Unique Features of Tiny Homes

Tiny homes often incorporate unique features and design elements to maximize space utilization. Some common features include lofted sleeping areas, multifunctional furniture such as collapsible tables and Murphy beds, and clever storage solutions like built-in shelves and hidden compartments. These innovative design choices make tiny homes highly efficient and functional despite their compact size.

Importance of Insurance for Tiny Homes

Protection against Accidents and Natural Disasters

Accidents can happen to anyone, and tiny homeowners are not exempt from this. Whether it is a fire, a burst pipe, or accidental damage, having insurance for your tiny home can provide you with financial protection in the event of an unforeseen accident. Additionally, tiny homes, especially those on wheels, may be more susceptible to damage from natural disasters such as tornadoes or hurricanes, making insurance coverage even more crucial.

Coverage for Personal Property

In addition to the physical structure of your tiny home, insurance also provides coverage for personal property inside your home. This includes your furniture, appliances, electronics, and other belongings. If any of these items are damaged or stolen, your insurance policy can help cover the cost of repairing or replacing them.

Liability Coverage

Liability coverage is essential for any homeowner, including owners of tiny homes. If someone were to get injured on your property, whether it is inside your tiny home or in the surrounding area, you could be held liable for their medical expenses and any legal fees resulting from a lawsuit. Liability coverage in your insurance policy can help protect you from these potential financial burdens.

Factors Affecting Insurance for Tiny Homes

Building Materials and Construction Quality

The materials used in the construction of your tiny home can impact your insurance options and premiums. Homes constructed with high-quality, durable materials are generally seen as less risky to insure. On the other hand, homes built with lower-quality materials may be considered higher risk, and therefore, could result in higher insurance premiums.

Location of the Tiny Home

The location of your tiny home can also affect your insurance coverage. If your tiny home is situated in an area prone to natural disasters such as flooding, hurricanes, or wildfires, insurance companies may consider it a higher risk and adjust your premiums accordingly. Additionally, the proximity of your tiny home to emergency services and fire hydrants may also be taken into account when determining your insurance rates.

Intended Use of the Tiny Home

The intended use of your tiny home can impact your insurance options. If your tiny home is used solely as a primary residence, you will need a different type of coverage compared to someone using their tiny home as a vacation property or rental unit. It is crucial to communicate your intended use to your insurance provider to ensure you have the appropriate coverage.

Insurance Options for Tiny Homes

Specialty Tiny Home Insurance Companies

There are insurance companies specifically dedicated to providing coverage for tiny homes. These specialty insurers understand the unique needs and risks associated with tiny home ownership and can offer tailored coverage options. Working with a specialty tiny home insurance company can provide you with the peace of mind that comes with knowing your policy is designed to meet your specific needs as a tiny homeowner.

Standard Homeowners Insurance

In some cases, it may be possible to obtain insurance for your tiny home through a standard homeowners insurance policy. However, it is important to note that not all homeowners insurance policies will cover tiny homes. If you choose this option, make sure to check with your insurance provider and inquire about any specific requirements or limitations that may apply.

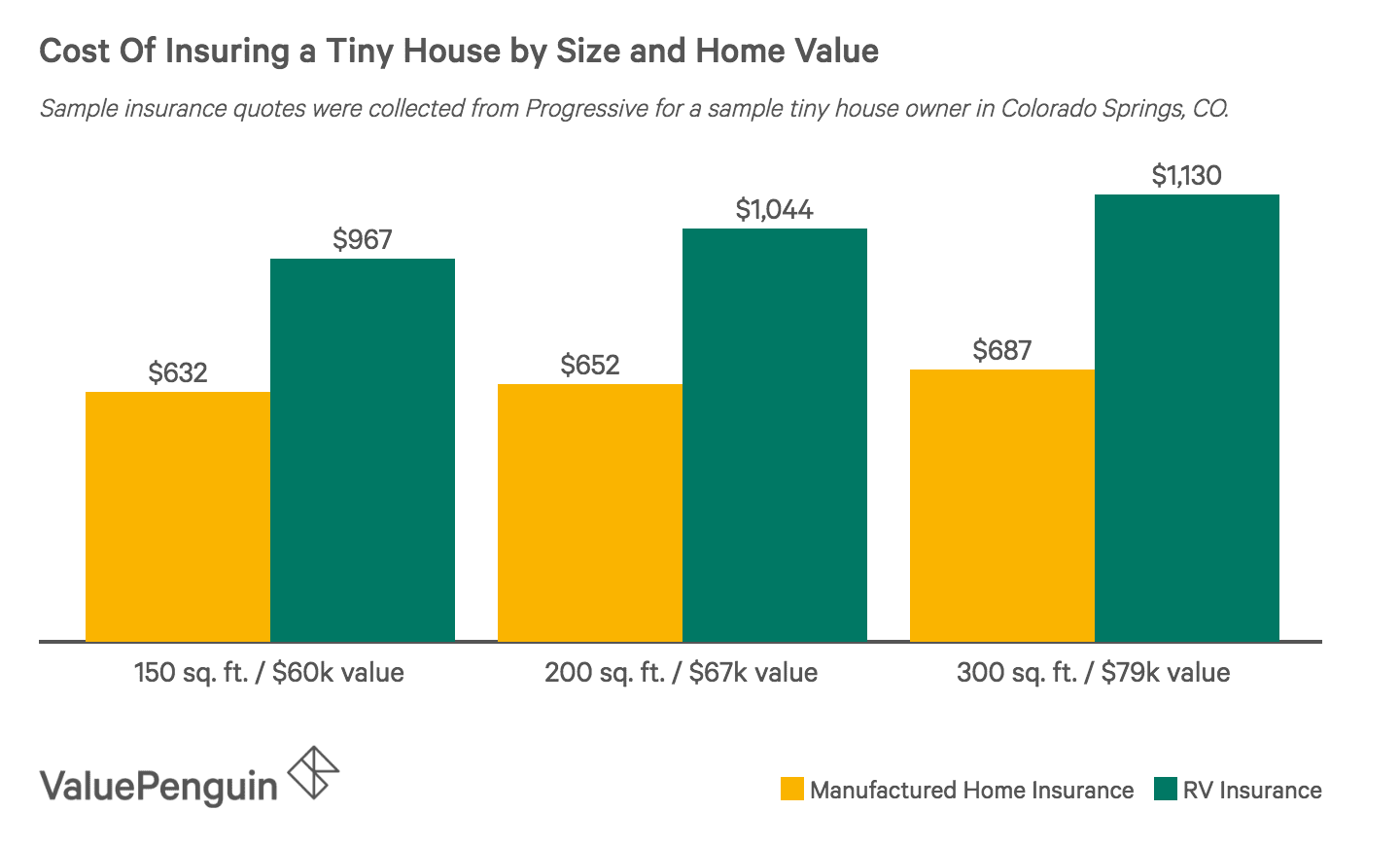

RV Insurance

For tiny homes on wheels, RV insurance may be a viable option. Many tiny homes on wheels meet the criteria for recreational vehicles and can be insured as such. RV insurance policies can provide coverage for both the physical structure of the tiny home and its contents, similar to other types of homeowners insurance.

Benefits of Specialty Tiny Home Insurance Companies

Tailored Coverage

One of the primary benefits of working with a specialty tiny home insurance company is the ability to obtain tailored coverage. These companies understand the unique risks and challenges faced by tiny homeowners and can customize your policy accordingly. This means you can have peace of mind knowing that your coverage is designed specifically for your tiny home and its specific features.

Knowledge of Tiny Home Industry

Specialty tiny home insurance companies have in-depth knowledge and experience in the tiny home industry. They understand the intricacies of building materials, construction methods, and safety regulations specific to tiny homes. This specialized knowledge enables them to accurately assess the risks associated with insuring a tiny home and provide appropriate coverage.

Understanding Unique Risks

Tiny homes present some risks that may be unique to their size and design. For example, the compact nature of tiny homes can increase the likelihood of accidents due to limited space and potential hazards. Specialty insurance companies are aware of these risks and can include coverage options that specifically address these concerns, giving you comprehensive protection for your tiny home.

Coverage Offered by Specialty Tiny Home Insurance Companies

Dwelling Protection

Specialty tiny home insurance companies typically offer coverage for the physical structure of your tiny home, including protection against damage from accidents, natural disasters, and theft. This coverage can help cover the cost of repairs or reconstruction in the event of a covered loss.

Contents Coverage

Contents coverage protects your personal belongings inside your tiny home. Specialty insurers can offer coverage for your furniture, appliances, electronics, and other personal property, ensuring that you are financially protected in the event of damage or theft.

Personal Liability Coverage

Personal liability coverage is a vital component of any insurance policy. It protects you financially if someone is injured on your property and holds you liable for their medical expenses or legal fees. Specialty tiny home insurers can provide personal liability coverage tailored to the unique risks associated with tiny home ownership.

Standard Homeowners Insurance for Tiny Homes

Pros and Cons

Opting for a standard homeowners insurance policy for your tiny home has its pros and cons. On the positive side, standard homeowners insurance policies typically offer comprehensive coverage options, including dwelling protection, contents coverage, and liability coverage. However, it is important to note that not all homeowners insurance policies will extend coverage to tiny homes, so it may require some research and discussion with insurance providers to find a suitable policy.

Requirements and Limitations

When considering standard homeowners insurance for your tiny home, be aware that there may be specific requirements and limitations. Insurance companies may have minimum square footage requirements or other criteria that must be met to qualify for coverage. Additionally, certain features unique to tiny homes, such as lofted sleeping areas or composting toilets, may need to meet specific regulations or be approved by the insurance company.

Eligibility Criteria

The eligibility criteria for standard homeowners insurance can also impact your ability to obtain coverage for your tiny home. Factors such as the location of your tiny home, the presence of an existing dwelling on the property, or the type of foundation your tiny home is built on may influence your eligibility. It is crucial to discuss these factors with insurance providers to determine if your tiny home meets their eligibility criteria.

RV Insurance for Tiny Homes

Benefits and Drawbacks

Insuring your tiny home as an RV can have its advantages and disadvantages. The benefits of RV insurance include coverage for both the physical structure and contents of your tiny home, as well as liability coverage. Additionally, RV policies often provide coverage specifically tailored to the unique risks associated with mobile homes. However, it is important to note that not all tiny homes will meet the criteria for RV insurance, especially if they do not have wheels or are not built to RV standards.

Considerations for Mobile Tiny Homes

For mobile tiny homes, RV insurance may be an excellent option. These homes are designed to be moved frequently, and therefore, they are subject to additional risks, such as transportation accidents or damage incurred during travel. RV insurance policies are typically more suited to address these risks, providing coverage that is specifically designed for mobile structures.

Eligibility and Coverage

To determine if your tiny home is eligible for RV insurance, it is necessary to meet certain criteria set by insurance providers. The specific requirements may vary, but generally, the tiny home must meet the size, weight, and construction standards of an RV. Additionally, insurance providers may require documentation, such as proof of RV certification or registration, to validate the eligibility of your tiny home for RV insurance.

Tips for Finding the Right Insurance

Assess Your Unique Needs

Before securing insurance for your tiny home, take the time to assess your specific needs. Consider the size, construction, and location of your tiny home, as well as your intended use for the property. Understanding your unique requirements will help you navigate insurance options more effectively and ensure you have adequate coverage.

Research and Compare Insurance Providers

Research and compare different insurance providers to find the one that best meets your needs. Look for insurance companies that specialize in tiny homes or offer policies specifically designed for these dwellings. Consider factors such as coverage options, premiums, and customer reviews to make an informed decision.

Speak with Insurance Professionals

If you are unsure about the type of insurance that suits your tiny home, reach out to insurance professionals. They can provide guidance and answer any questions you may have about insurance coverage for tiny homes. Insurance agents or brokers who specialize in tiny homes or recreational vehicles can offer valuable insight into the unique insurance needs of tiny homeowners.

Review Policy Details Thoroughly

When selecting an insurance policy for your tiny home, thoroughly review the policy details before making a final decision. Pay attention to coverage limits, deductibles, exclusions, and any additional endorsements or riders that may be available. Understanding the terms and conditions of your policy will ensure that you have the appropriate coverage for your tiny home.

In conclusion, insuring a tiny home involves considering the unique aspects and risks associated with these dwellings. Specialty tiny home insurance companies, standard homeowners insurance, and RV insurance offer different coverage options, each with its own pros and cons. By understanding the factors affecting insurance for tiny homes and following these tips, you can find the right insurance policy to protect your tiny home investment. Remember to assess your needs, research insurance providers, consult professionals, and carefully review policy details to make an informed decision. With proper insurance in place, you can have peace of mind knowing that your tiny home is protected financially.